Affordable Bankruptcy Attorneys Serving Evergreen Park, IL

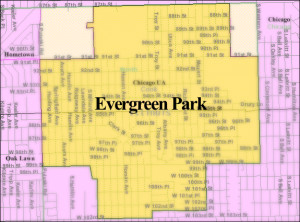

Residents of Evergreen Park, IL know a thing or two about resilience. The ever-independent village has a rich 116-year history of progressing and flourishing despite the highs and lows of the economy. The transformation of the aging and mostly vacant Evergreen Plaza into the highly anticipated Evergreen Park Marketplace is one of many examples of the ability of people in the 60805 ZIP Code to bounce back from adversity.

Residents of Evergreen Park, IL know a thing or two about resilience. The ever-independent village has a rich 116-year history of progressing and flourishing despite the highs and lows of the economy. The transformation of the aging and mostly vacant Evergreen Plaza into the highly anticipated Evergreen Park Marketplace is one of many examples of the ability of people in the 60805 ZIP Code to bounce back from adversity.

If you are an Evergreen Park resident or business owner challenged by financial adversity, you owe it to yourself to use all the tools available to help you bounce back as quickly as possible. Despite the perceived stigma of filing for personal or business bankruptcy, it may be the smartest step you can take to improve your financial situation. The experienced team of bankruptcy attorneys at Thomas W. Lynch & Associates, P.C. has been helping residents and business owners of Evergreen Park and surrounding Chicagoland areas resolve their overwhelming debt problems for more than 20 years. They can help you take control of your financial future starting today.

Do not let overwhelming debt continue to burden you. Call (708) 598-5999 today to schedule a free, in-person consultation with an affordable debt lawyer at Thomas W. Lynch & Associates. You can also use our online contact form to submit questions about our bankruptcy services.

Explore Your Personal Bankruptcy Options

Fortunately, Illinois bankruptcy laws provide a variety of personal debt relief options to individuals who are struggling with debts they cannot afford to repay. Chapter 7 bankruptcy and Chapter 13 bankruptcy are the two most popular personal bankruptcy choices. The bankruptcy lawyers at Thomas W. Lynch & Associates, P.C. can help you determine which option is best for your situation.

Fortunately, Illinois bankruptcy laws provide a variety of personal debt relief options to individuals who are struggling with debts they cannot afford to repay. Chapter 7 bankruptcy and Chapter 13 bankruptcy are the two most popular personal bankruptcy choices. The bankruptcy lawyers at Thomas W. Lynch & Associates, P.C. can help you determine which option is best for your situation.

Chapter 7 Personal Bankruptcy

If you lost your job or are struggling to make ends meet in a job that pays lower than average wages, a Chapter 7 filing may be most appropriate for your circumstances. Once you file Chapter 7, all debt collection activities against you must stop. Debt collectors can no longer call your home or garnish your wages and any actions to foreclose on your home or repossess your vehicle will be halted until a bankruptcy judge decides whether those actions can proceed.

In most cases, you will be allowed to keep your furniture, clothing, and household items. Depending on its value and whether there is a lien against it, you may also be able to keep your car. You will almost certainly be allowed to keep your pension or retirement account. All your debt, except non-dischargeable debts like student loans, child support and certain tax obligations, will be discharged without repayment.

Chapter 13 Bankruptcy

If you make a good income but are still unable to pay all your debts, Chapter 13 may be your best option. Like Chapter 7, filing for Chapter 13 bankruptcy will stop harassing collection activity against you. However, this type of filing involves a repayment plan that allows you to catch up on delinquent secured debt. Chapter 13 is often a good choice for people who want to save their homes from foreclosure.

Once you file, you will stop making payments on unsecured debt like credit cards and medical bills. These creditors will only be paid if there is money left over in your repayment plan after your secured debts are paid. Even if you have paid little or no money toward your unsecured debts at the end of your Chapter 13 bankruptcy, they will be completely discharged.

Filing bankruptcy under Chapter 13 may be viewed more favorably than Chapter 7 by future creditors because it shows a good faith effort to repay your debts.

Discuss your personal bankruptcy options with an experienced bankruptcy attorney today. Call (708) 598-5999 to schedule a no-obligation appointment with Thomas W. Lynch & Associates, P.C. You can also complete our online contact form to have someone from our office contact you.

Bankruptcy Options for Business Owners

Just like individuals, businesses fall on hard times. Bankruptcy laws offer businesses similar debt relief options. Chapter 7 and Chapter 11 are the most common bankruptcy filings for businesses.

Just like individuals, businesses fall on hard times. Bankruptcy laws offer businesses similar debt relief options. Chapter 7 and Chapter 11 are the most common bankruptcy filings for businesses.

Chapter 7 Business Bankruptcy

For corporations that are failing and ready to close their doors, Chapter 7 may be the smartest option. Creditor collections and threatening lawsuits will stop and you will have the opportunity to move forward and make a fresh start. In this type of bankruptcy, you turn over business assets and debts to the bankruptcy trustee. The trustee liquidates your business, saving you the time and effort of paying creditors from the sale of your business property.

Chapter 11 Business Bankruptcy

For struggling businesses that hope to rebuild after bankruptcy, Chapter 11 may be the best choice. This type of filing allows you to stay in business while a bankruptcy judge oversees the reorganization of your business’ debt obligations.

Whatever your business debt problems, Thomas W. Lynch & Associates, P.C. has the experience to help you take control of your company’s financial situation. Call us now at (708) 598-5999 for a free, confidential consultation. You can also request an appointment by using our online contact form.

Federal and bankruptcy litigation on behalf of individuals, family-owned businesses, and multi-national companies are Attorney Michael Martin-Johnston’s main areas of expertise gained from his time at the Illinois Attorney General’s Office.