If you purchased or refinanced a home in 2014 and plan to itemize your deductions this year there are 12 smart home deductions that may be able to shrink your tax bill. A new Trulia article offers a convenient break down of each deduction. While most homeowners are aware they can deduct mortgage interest and paid property tax from their tax bill, many new homebuyers may not know they can also deduct origination fees on their loan–even if they were paid by the seller. Homeowners who refinanced their mortgage last year can deduct points paid on an adjusted basis. Working with a tax professional can help ensure you reap the benefits of all the tax credits and deductions available to homeowners.

If you purchased or refinanced a home in 2014 and plan to itemize your deductions this year there are 12 smart home deductions that may be able to shrink your tax bill. A new Trulia article offers a convenient break down of each deduction. While most homeowners are aware they can deduct mortgage interest and paid property tax from their tax bill, many new homebuyers may not know they can also deduct origination fees on their loan–even if they were paid by the seller. Homeowners who refinanced their mortgage last year can deduct points paid on an adjusted basis. Working with a tax professional can help ensure you reap the benefits of all the tax credits and deductions available to homeowners.

To learn more about all 12 home deductions, read the full article.

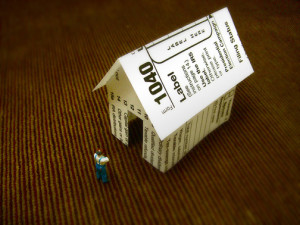

Image Source: JD Hancock